Effective Origination Enabled.

Imagine a world where your approval rates go up to 99%.

Reduce processing time from 4-6 weeks to 3-4 days.

Stop wasting time and money on SME applicants you can’t underwrite.

Up to 70% of all SME loan applications are rejected by Indian lenders. On average it takes between 4-6 weeks to process these applications.– Source World Bank, RBI

Recommendations From Our Lender Partners

Recommendations From Our Lender Partners

Profitable Lending. Enabled Simply.

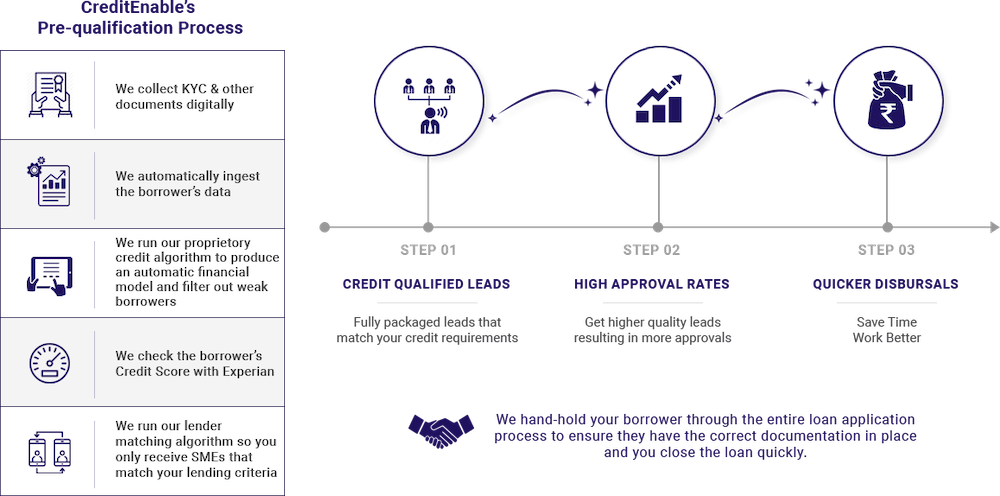

How it works

Unsecured loans disbursed in 2-3 days | Secured loans disbursed in maximum 7 days

Profitable Lending.

Enabled Simply.

How it works

Unsecured loans disbursed in 2-3 days | Secured loans disbursed in maximum 7 days

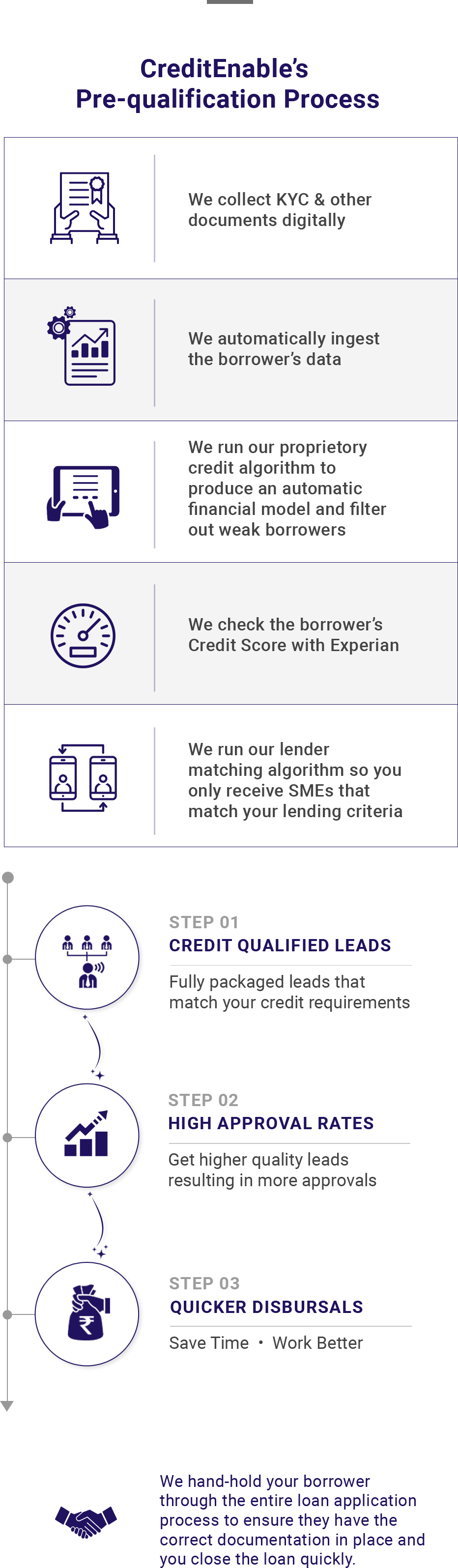

Fully Digital Origination.

Quickly generate a set of pre-qualified leads. Automatic pre-approved candidates aligned to your risk profile.

Easy Lending. Enabled Simply.

Tools for Origination and Credit Assessment.

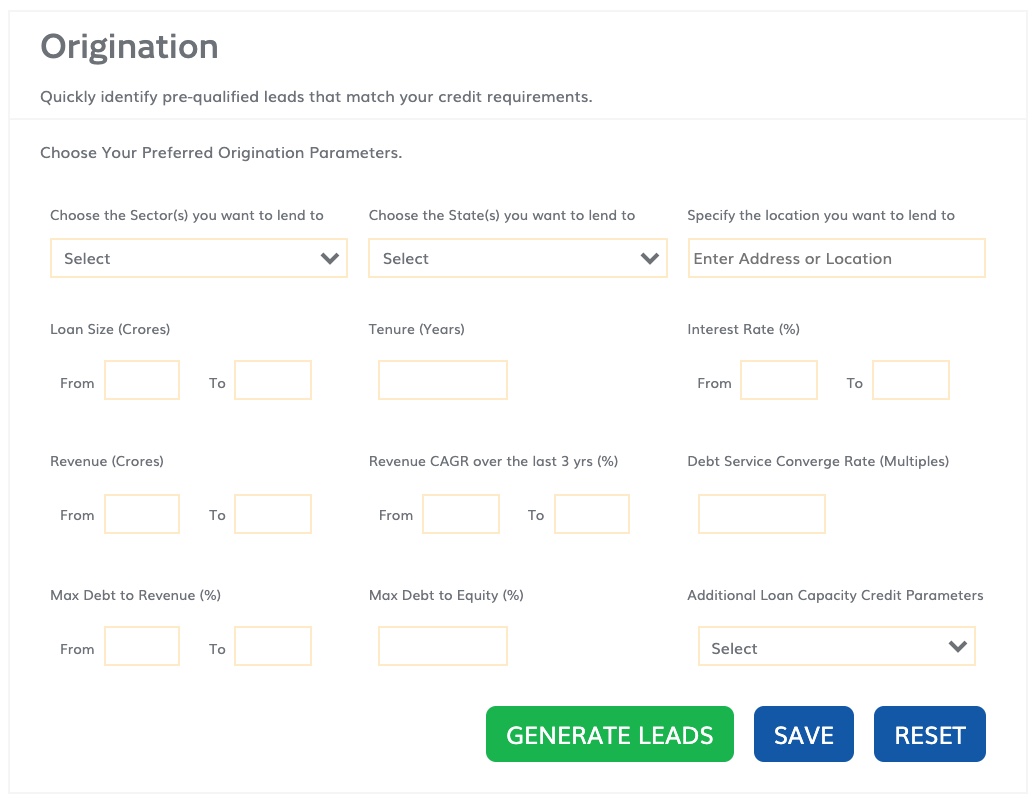

Loan Eligibility Assessments.

Loan eligibility assessments at the click of a button.

Accurately and reliably calculate the total absorptive capacity of a borrower based on reliable financial forecasts and objective criteria.

Achieve a 99% efficiency improvement in the time it takes your credit analysts to complete a capacity to pay assessment on a loan.

Reduce mistakes and remove subjective determinations from the assessment process.

Robust Peer Comparisons.

Quickly compare the financial strength of a particular borrower against their peers for accurate loan pricing.

Key Ratio Trend Analysis.

Instantly compare key ratio trend analysis graphically.

Better Risk Management.Enabled Simply.

We understand how difficult it is to stay on top of the sector trends that might impact on your borrowers' ability to repay.

Imagine a world where everything you need to manage risk in your SME book is available on a single dashboard and where absolute losses can be reduced by up to 20%.

Get in TouchThe RBI puts NPAs in the MSME sector around 8.5 to 11%. These are set to increase as a result of enormous strain placed on this segment by COVID.– Source World Bank, RBI

Sector Trends.

Understand local, national, regional and global sector trends that can impact on a borrower's ability to repay debt.

Portfolio Optimisation.

Easily evaluate overall portfolio credit quality in light of changing sector dynamics, receive real-time notifications tailored to your portfolio to let you know when changes in sector credit quality occur so that you can reduce the probability of Non-Performing Loans.