Understanding the Lending Process.

Understanding the Lending Process.

Many times, SMEs turn to informal credit channels like friends or money lenders because formal credit lines can be difficult to navigate. From contacting a lender to submitting documents in the right format, the process can seem cumbersome.

CreditEnable has curated information to help SMEs better understand the lending process from the lender’s perspective, as well as how SMEs can prepare ahead of applying for a loan. From getting familiar with how the lending process works, how to apply for a loan, and how long it may take to get sanctioned, find answers to all your lending-related queries here.

Does my average bank account balance matter when I apply for SME business funding?

If you’ve ever applied for SME business funding, you know that lenders will ask you to submit your bank account statements dating back at least 12 months when you submit your loan application. But do you know why they ask for these statements? It’s to check how much money you have in your bank accounts…

How does a bounced cheque impact my small business loan prospects?

Your cheque bounced, and you weren’t able to make a payment when you said you would. It’s ok. Almost all of us have found ourselves in a similar situation. The bounce could have been for several reasons – you were moving money from one account to another but there was a technical delay, your signature…

Why is my business vintage significant when I apply for a small business loan?

You must have come across the term “business vintage” when you’re going through small business loan requirements. It may be an unfamiliar term to many, so let’s break it down. What does business vintage mean? Your business vintage simply means how old your business is or for how long your business has been operational. Now,…

The advantages of owning a registered business

Thinking about applying for a business loan, but you haven’t registered your company? You’re not alone! There are millions of entrepreneurs just like you who choose to not register their businesses, or don’t know that they need to register their business. Let’s learn what the benefits of registering your business are. What does it mean…

What are the Consequences of a Business Loan Default?

What does it mean to default on a business loan? Before a lender lends you a business loan, they will share some loan terms and conditions that you must agree to. If you fail to meet these agreed-upon terms after the loan is disbursed and don’t tell your lender in advance why you will be…

Defaulting on a Business Loan: What is it and how to avoid it

What does it mean to default on a business loan? When you fail to meet the agreed-upon terms of your business loan without prior communication with your lender, it is considered a default on your loan. There are two types of defaults: wilful and non-wilful. A non-wilful defaulter is genuinely in debt and unable to…

What is a cancelled cheque and why do I need to give one to my lender?

With most financial transactions being done digitally nowadays, most of us have no reason to use cheques. However, when you apply for a business loan, the lender will ask you to give them a ‘cancelled cheque’ before they disburse the loan to you. Why do they do that? Let’s find out! What is a cancelled…

Learn All About Business Machinery Loans

What is a business machinery loan? Having state-of-the-art machinery is vital to the long-term success of your business. Business machinery loans help you invest in buying new machinery/equipment, upgrade existing ones, or buy a new plant. Such loans are a great option for businesses looking to scale operations while keeping the profit margins and business…

Learn All About Working Capital Loans

A working capital loan is a perfect business funding option for when your business experiences a cash constraint. Business loans are not just to fund long-term investments but also to help meet your recurring expense requirements. What is a Working Capital Loan? A working capital loan is the perfect loan product to help you pay…

Learn All About Loan Against Property

You work hard to purchase commercial and residential property. Now it’s time to find out how your property can help you get funding to grow your business! What is a Loan Against Property? When you own a valuable personal or business asset, it can be used as collateral to secure a business loan. A loan…

Why Should I be Transparent on My Business Loan Application?

If you’re an entrepreneur applying for a business loan, how much information would you share with your lender? We recommend you be transparent with the lender and share the most accurate information on your business loan application. This will help the lender make a lending decision faster and increase their trust in you. Why? Let’s…

Learn All About Secured Business Loans

For an SME that has access to assets you can use as security for a loan, a secured business loan is a practical alternative to unsecured loans. When you pledge collateral for a loan, you can get access to a large loan amount as well as a longer loan tenure compared to an unsecured business…

Learn All About Unsecured Business Loans

What is an unsecured business loan? Unsecured business loans are a great funding option if you don’t own many assets or have no collateral to offer the lender as security, or if your business is growing fast and you need finance quickly. Unsecured business loans can be used to finance growth, invest in infrastructure, operations,…

Why Should I Submit My Business Loan Documents Online?

You’ve checked your business loan eligibility with CreditEnable, and you’ve passed our check. Congratulations! You’re about to join thousands of other SMEs who have got 100% digital business loans with CreditEnable! Now it’s time to share your documents with us so we can complete your application assessment and match you with an SME loan product…

Fixed and Reducing Interest Rates – Which One Should I Pick?

If you’re a first-time borrower, you may have heard about the different ways lenders calculate interest rates for a business loan, or you may not have. That’s ok, you’re not alone! So, we’re here to help you learn a little about the borrowing process and the kinds of interest rates lenders will offer you. Remember,…

Why Can’t I Use My Credit Card to Grow My Business?

You’re an SME who is looking for business financing. You don’t have access to collateral to get a business loan so, you’re thinking of just using your business credit card to cover your cash needs. As a credit specialist, CreditEnable recommends you apply for an Unsecured Business Loan instead of relying on your credit card…

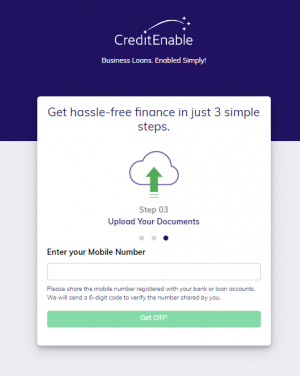

How To: Upload Your Business Loan Documents to the CreditEnable Document Portal

Once you’ve scanned all your business documents and gotten your bank account e-Statements for the last 12 months, uploading them to the CreditEnable Documents Portal is very simple. After you’ve passed our eligibility check, you are directly taken to the document upload page. We recommend uploading all your documents within 24 hours of completing your…

How To: Scanning Your Business Loan Application Supporting Documents

You have completed the CreditEnable survey and passed the loan eligibility check. Congratulations! You are one step closer to getting your business the funds it needs to grow! The next step in completing your application package is uploading scanned copies of your individual and business KYC documents onto the CreditEnable Documents Portal so that we…

How To: Download Your Bank Account e-Statements Online

You’ve submitted your business loan application with CreditEnable, and you pass our eligibility check! Congratulations! The next step to sending your complete application package to the lender is submitting your supporting KYC and business documents so that we can fully understand and analyse your application to negotiate better terms for your business loan! You can…

Four Questions on Business Loan Interest Rates Answered

Most small businesses, at one point in time or another, have to take out a business loan to function. This could be a working capital loan, machinery loan, loan against property or any other form of credit for their short-term or long-term needs. All borrowing comes at a cost, usually paid in the form of…