How to Improve Your Chances of Getting a Business Loan: Everything You Need to Know

Daily Tip: Download your GSTR-3B before applying for a business loan

Did you know when you apply for a business loan, you also need to submit your tax documents to the lender along with your loan application? Your GSTR-3B forms are one tax document the lender needs. Form 3B helps the lender assess your credit profile and allows them to make a lending decision faster. Downloading…

How do I get equipment financing for my small business?

If you’re thinking of investing in new machinery or equipment for your small business, equipment financing is the perfect loan option for you. What is equipment financing? Equipment financing, also known as machinery loans in India, help small businesses purchase machinery for their operations. Equipment financing is a great way to invest in new machinery…

Daily Tip: Remember to meet all your GST obligations in December

December will be a flurry of activity with holiday and tax season right around the corner! Remember to keep up with your GST obligations between completing your tax documents and holiday celebrations. Depending on the type of business you own, or the type of GST payment schedule you follow, your GSTR filings for November 2021…

Daily Tip: Deadline to deposit TCS/TDS for November is December 7

Stay on top of your tax obligations and improve your attractiveness to lenders! The deadline to deposit the cash collected and deducted at source in November 2021 is December 7. If you collect or deduct tax at source, don’t forget to deposit the collected amount with the tax authority. Click here for all deadlines in…

Credit Score and Credit Report: Are they different?

As an individual or a business owner who has borrowed from a formal lender or is using a credit card, you may have heard about your credit score and credit report. In India, we tend to use the terms “bureau score”, “CIBIL score”, “credit score”, and “credit report” interchangeably. While the first three terms –…

Daily Tip: Ensure you have a PAN before applying for a business loan

Did you know it is mandatory to have a Permanent Account Number (PAN) to qualify for a business loan? And if your company is legally required to have a PAN to do business in India, you will need to submit both the proprietor’s and your business PANs with your loan application. Lenders use your PAN,…

Daily Tip: Don’t let a low credit score hold you back. Improve it!

Let’s talk about your credit score. It’s more commonly known as your bureau or CIBIL score in India. If you are a first-time borrower, you may not know much about your credit score, so you may not pay too much attention to it. Credit bureaus authorised by the RBI prepare a credit report for each…

Can I get an SME loan if I defaulted on a business loan in the past?

As an entrepreneur, you know ups and downs in business are common. You can’t always be sure what your cash inflow will be from one month to the next, but your overhead costs remain constant. In such instances, you may not be able to pay your EMIs on time, whether they’re for a business loan…

Daily Tip: Shorten your SME loan TAT by preparing your documents before applying

If you’ve ever shopped around for a business loan, you may have heard the term “TAT” or turnaround time. The SME loan TAT is how long it may take to get your loan. Nowadays, you come across a variety of TATs – ranging anywhere from hours to days. But why is there such a disparity…

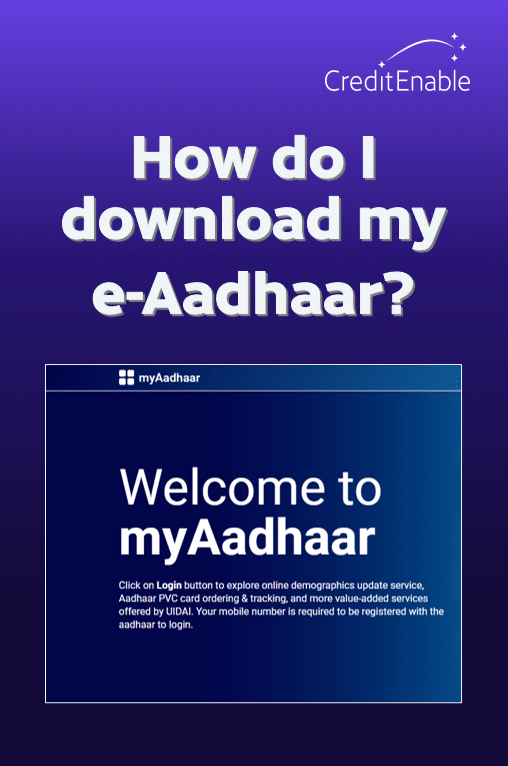

How To: Download my e-Aadhaar Online

Whether it’s applying for an SME loan or opening a bank account, your Aadhaar is the most important form of identification you need in India. We advise you to always have it on your person in physical or electronic form in case you need to use it. Here’s how to download your e-Aadhaar in just…