How to Improve Your Chances of Getting a Business Loan: Everything You Need to Know

Daily Tip: Use technology to grow your business faster

The pandemic has led to many changes in our personal and professional lives. However, by introducing technology in your business operations, you can continue working remotely from anywhere, work more efficiently, and also grow your customer base! Some things you can do to grow your business using technology: 1. Sell on an e-commerce platform like…

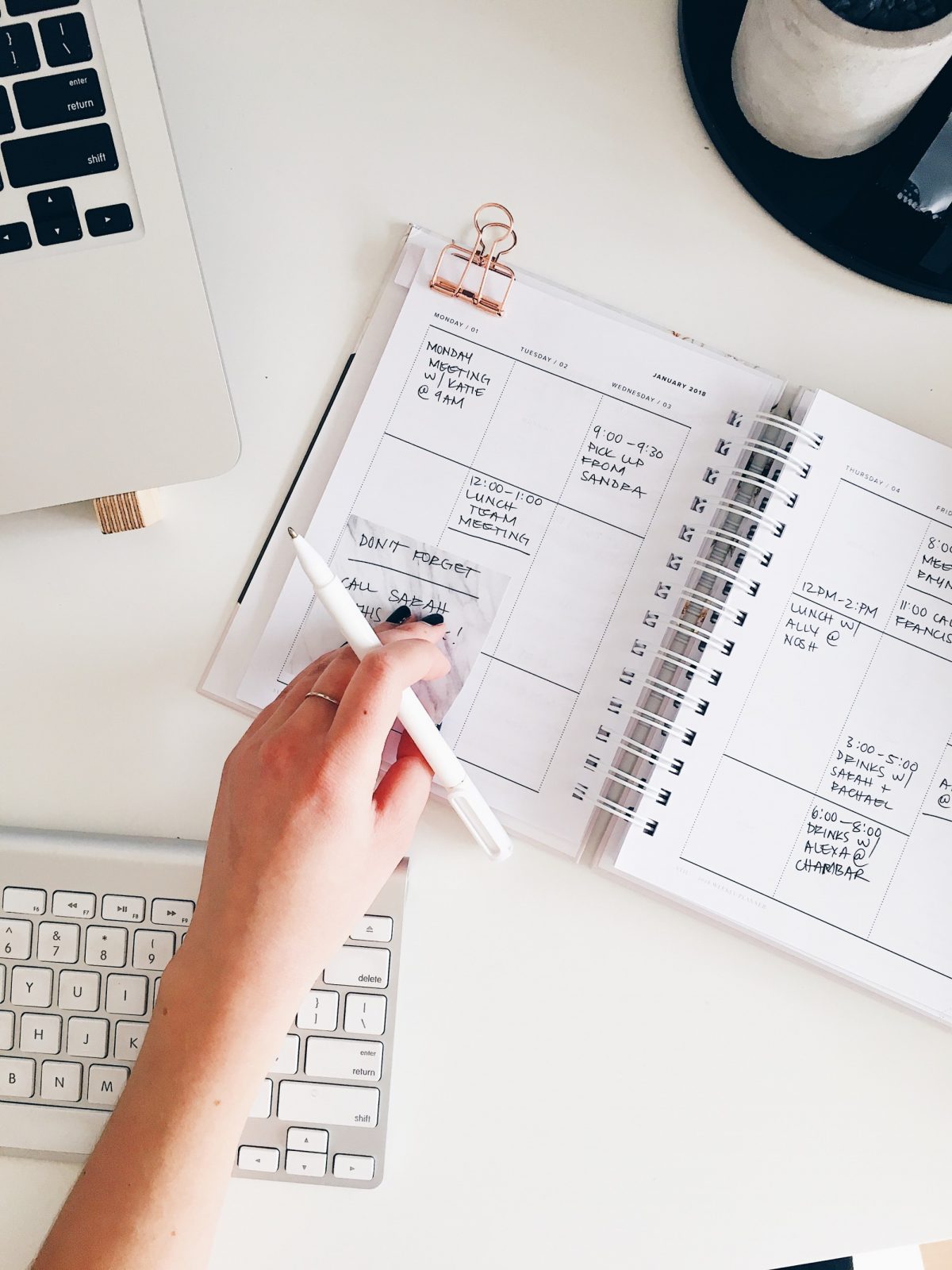

10 ways to maintain your work-life balance as an entrepreneur

Let’s talk about work-life balance. Your business is your baby. We understand that. CreditEnable is also a small business building itself up day-by-day, and we understand how much time, effort, and attention you put into each customer transaction. Behind every successful small business is an enthusiastic, always busy, and somewhat always tired entrepreneur who deserves…

Daily Tip: Improving your credit score is hard but not impossible!

Are you worried your credit score may negatively impact your chances of getting the business loan you need to grow? This is a valid concern as your credit report is a crucial piece of financial information lenders will review before they decide to lend to you. Any major financial transaction you make, from applying for…

Daily Tip: If you own collateral, a secured business loan is your best option

When you’re in need of a business loan and own assets that you can put up as loan collateral, you can get a secured business loan. In exchange for collateral, lenders will offer you a loan with a: Larger loan amount Attractive interest rate Loan tenure ranging from 12 months to 20 years The exact…

What does it mean to default on a loan?

What does it mean to default on a business loan? When you fail to meet the conditions of your business loan without any warning given to your lender, it is considered a default on your loan. There are two types of defaults: Wilful – When you are in a strong financial position and can repay the…

Loan against property and secured loan: Are they different?

What is a loan against property (LAP)? A loan against property is a business loan you get if you own valuable personal or business property that can be pledged as collateral for the loan. Such a loan can be used to finance long-term business funding needs, business expansion plans, purchase new property and equipment, or…

Daily Tip: Your individual credit score impacts your chances of getting a business loan!

Does your personal credit score impact a lender’s decision to offer you a business loan? Yes, it does! A lender will check your personal credit score, in addition to your business credit report, when they’re deciding to lend to your business. Your business and personal credit histories can affect: Whether or not you get approved…

Daily Tip: GSTR-3B filing late fee amnesty scheme ends soon

According to the Goods and Services Tax Act, taxpayers cannot file a particular tax period’s GSTR-3B without filing the previous ones. You also risk having your GST registration cancelled if you haven’t filed GSTR-3B for six consecutive tax periods or three consecutive quarters! Losing your registration may impact your clients, or GST registered customers could…

Daily Tip: Get an unsecured business loan if you don’t own collateral

Unsecured business loans are a great option for first-time borrowers or businesses who don’t own much (or any) collateral to offer lenders. They are relatively easier to get compared to secured business loans. Due to the lack of collateral, lenders can process and sanction unsecured business loans faster because they don’t have to spend time…

Daily Tip: Be transparent when applying for a business loan

Are you applying for a business loan? Be transparent on your business loan application to increase your chances of getting approved for the loan! Lenders use numerous methods to verify the information you provide on your business loan application and in your interactions with them. So, being transparent helps build trust with your lender and…