When you apply for a business loan, your lender will ask you to submit proof of your business vintage along with a few other business loan documents. If you’re an SME, you should have an Udyam Registration Certificate. This document, along with your Current Account passbook, can be used as proof of your business vintage.

What is an Udyam Certificate?

An Udyam registration number is a 19-digit alphanumeric unique identification number issued to Micro, Small, and Medium Enterprises (MSMEs) by the Ministry of MSMEs. If your business falls within the micro, small or medium categories and you do business in India, you can get your Udyam certificate through the Udyam registration portal.

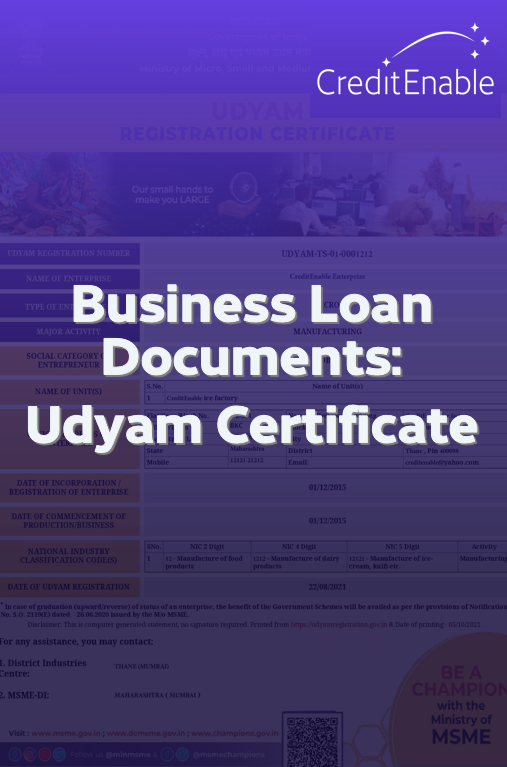

Here is a sample of an Udyam certificate:

The Udyam Certificate contains your Udyam registration number, your business category (micro, small or medium) and your business’s date of incorporation and commencement of business.

Why do I need to submit my UDYAM Certificate to my lender to get a business loan?

When you apply for a business loan, you need to submit a few business loan documents with your application form. Lenders use these documents to verify the information you provide in your application and assess your creditworthiness for the loan. One factor lenders use to determine your creditworthiness is your business vintage, or how long your business has been operational and registered. The higher your business vintage is, the better the loan terms offered.

The Udyam Certificate or any other government-issued document with your business’s incorporation date is proof of your business vintage.

Lenders accept your Udyam Certificate and a copy of your Current Account passbook as your business vintage proof. Since the information on your Udyam Certificate is self-declared, the lenders have no way to verify it. Your current account passbook helps the lender verify your date of incorporation and commencement of business.

When you apply for a business loan, your lender requires you to submit some supporting business loan documents along with your business loan application. When you apply for an SME loan using CreditEnable’s technology platform, we will tell you upfront what business loan documents to provide to get the loan quickly and on preferable terms. This way, there are no surprises during the loan underwriting process, and you can get your loan without any delay.

Apply for a business loan using CreditEnable’s free service today!

Business Loans. Enabled Simply.