If you’re interested in applying for a hassle-free business loan, you’ve come to the right place! CreditEnable partners with 25+ leading lenders in India, including ICICI Bank, Kotak Mahindra Bank, Bajaj Finserv, and Lendingkart, to get you the best business loan at the most favourable lending terms!

We’ve enabled Unsecured Business Loans in just 2-3 days at interest rates starting at 14%, and Secured Business Loans in about 7 days at interest rates starting at 8%+! We also enable Machinery Loans, Loans Against Property, Working Capital Loans, and Overdraft facilities!

Here are step-by-step instructions to use CreditEnable’s technology platform to check your eligibility for a business loan and submit your loan application.

How do I apply for an SME loan using CreditEnable?

Step 1: Visit loans.creditenable.com

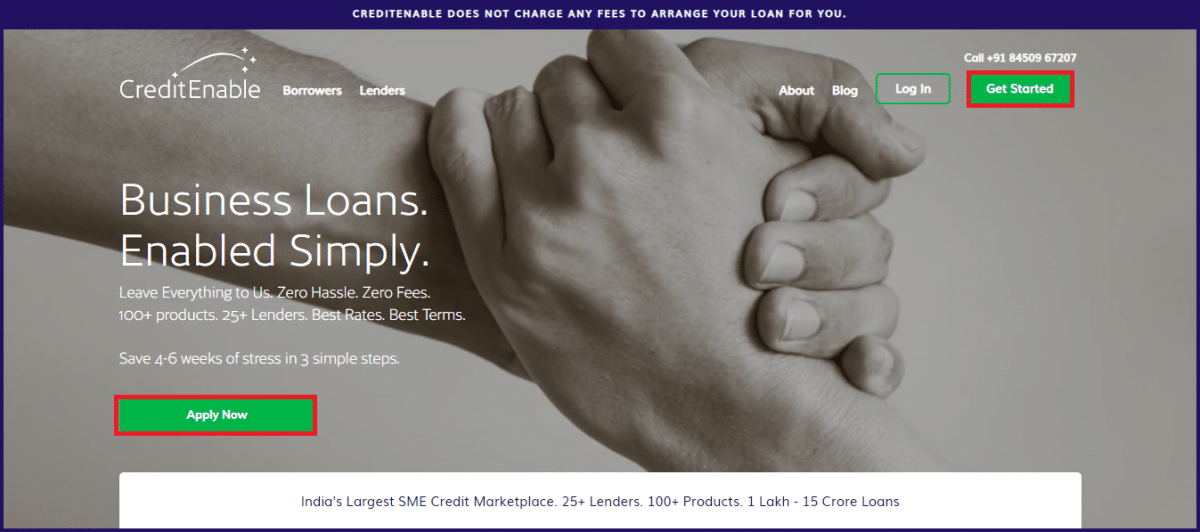

Step 2: Click on the “Apply Now” or “Get Started” green buttons.

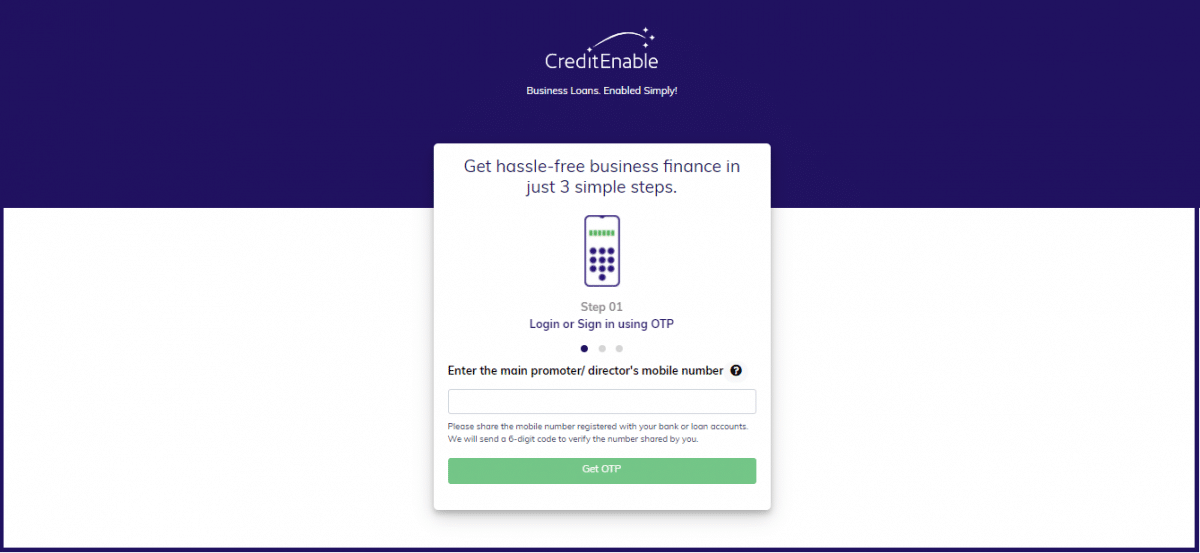

Step 3: You are now redirected to the registration page.

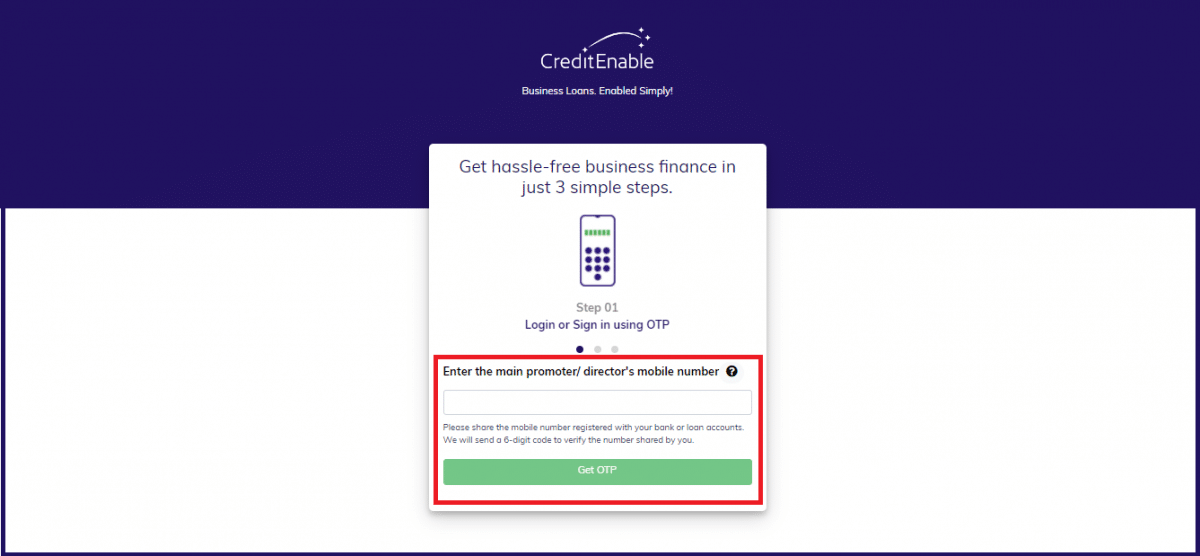

Step 4: Enter your mobile number in the given space and click on the “Get OTP” green button.

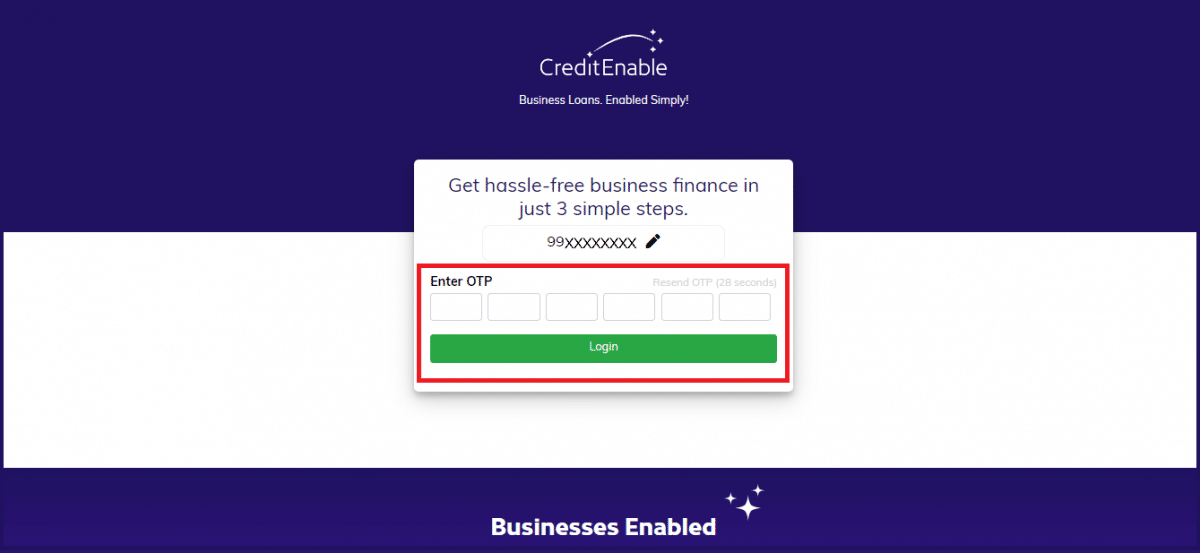

Step 5: Enter your OTP in the given space and click on the “Login” button.

Congratulations! You’ve successfully registered with CreditEnable. Next, answer our short survey (this will only take 2 minutes) share your basic demographic and business information with us so we can check your eligibility for a business loan.

To check your eligibility, we do a soft enquiry of your Experian report to see if your credit score is 750 or above and matches our lender partners’ requirements.

You don’t need to worry about any negative impact on your credit score as this is not an application for business funding yet. Since we are checking your score on your behalf, this pull protects your credit score.

If you are eligible, all you need to do is upload the required documents, and we’ll get to work matching you with the best lender!

Find out business loan documents you will need to submit.

Why should I use CreditEnable to apply for a business loan?

- CreditEnable’s service is 100% free to use for SMEs.

- We’re simplifying the business loan process, so SMEs don’t have to wait 4-6 weeks to hear back from a bank.

- We partner with 25+ lenders, and we’re adding new ones to our network every quarter to help even more SMEs get the business funding they need when they need it.

- Our application process is fully digital, from checking your eligibility, uploading your documents, and submitting your complete application to the lender.

- We take your data privacy very seriously. We follow all the necessary data-protection laws in India and are also compliant with the General Data Protection Regulation (GDPR) from the EU. You can read more about our data protection in our Privacy Policy.

- Our award-winning lender-matching technology will match you with the most appropriate lender for your business based on the information you share with us to ensure you can quickly get the loan you need.

- We only do a soft pull of your Experian credit score, meaning checking your eligibility with us has zero impact on your bureau score.

- Our process is transparent, meaning we keep you updated on the progress of your application.

- We believe in empowering SMEs with the appropriate information to make fully informed decisions that will help your business. So, no matter how many questions you have, and no matter how easy or complex, we’ll help you find the answer.

Submit my business loan application with CreditEnable!

Business Loans. Enabled Simply.