When you apply for a business loan, lenders will ask you to submit some supporting documents along with your loan application. Your financials, bank statements, ITRs, and GSTR-3B forms (if applicable), may be included in the list of supporting documents.

Learn about the GST tax regime.

If you are a GST-registered business, you should be filing your GSTR-3B form every month. As mentioned previously, when you apply for a business loan, GST-registered businesses must submit their GSTR-3B forms for the past 12-months (unless you are exempt from filing them).

Here is a simple step-by-step guide to help you download your GSTR 3B forms online in just 4 steps!

How do I download my GSTR-3B online?

Start by visiting the GST Portal.

Step 1: Enter your Username, Password, and CAPTCHA code to login.

Step 2: On the next page, scroll down and click on the “Returns Dashboard” option at the bottom of the screen on the left.

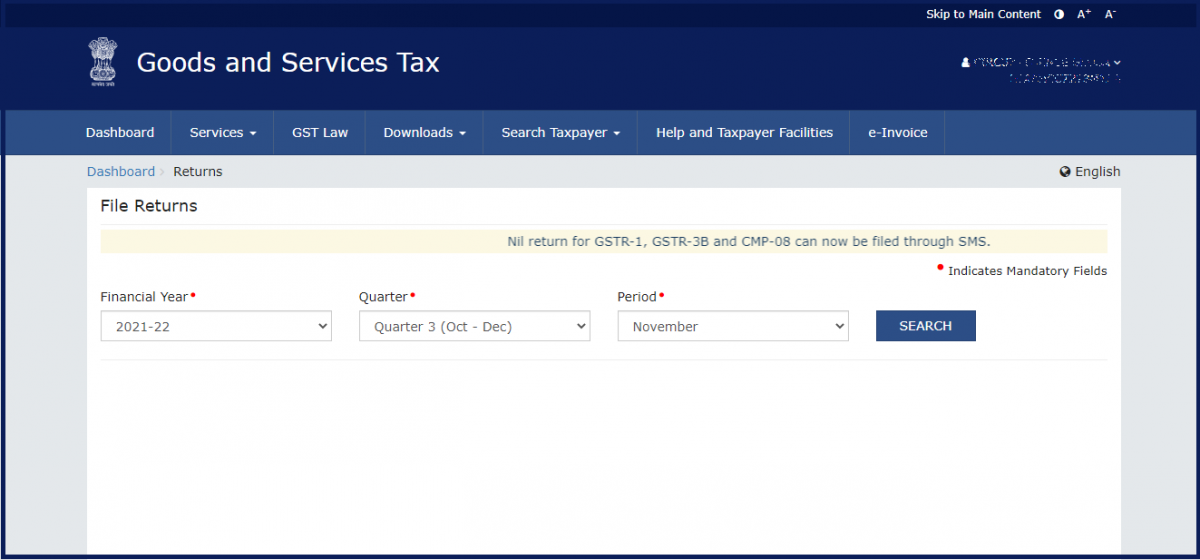

Step 3: You will now see the page below. Select the respective information in the Financial Year, Quarter, and Period categories and click on “Search Period”.

Step 4: The option to View or Download your GSTR-3B form is at the bottom of the page on the left. Click on the “Download” option and your form should start downloading.

What is the GSTR-3B?

The GSTR-3B is a self-declared summary of your GST return filed every month (or quarterly for QRMP scheme subscribers) along with GSTR 1 and GSTR 2 return forms. It. It became mandatory for a registered taxpayer to file starting July 2017.

Some things to remember about the GSTR-3B:

- You need to file a separate GSTR-3B for every GSTIN.

- You must pay your GST liability on or before the date of filing your GSTR-3B.

- Once filed, the GSTR-3B cannot be modified.

- You must file your GSTR-3B even if you have zero liability.

All GST registered taxpayers must file their GSTR-3B every month, except for the following businesses:

- Input Service Distributors & Composition Dealers

- Suppliers of OIDAR (Online Information Database Access and Retrieval Services)

- Non-resident taxable persons

When is the GSTR-3B due?

Since your GSTR form is a monthly return form, you need to file it every month unless you file your forms quarterly for QRMP. The deadline for submission every month is the 20th of the following month.

For example, your GSTR-3B for October 2021 must be filed by 20th November 2021.

Do I need a GST registration to get a business loan?

Yes, you can get a business loan if you’re not a GST registered business if:

- The goods or services you provide are exempt under GST law.

- Your business does not fulfil the mandatory GST requirements.

- You don’t meet the minimum annual turnover threshold under GST law.

Learn more about who needs a GST registration here.

CreditEnable’s lender partners provide business loans to both GST and non-GST businesses if you meet the other loan eligibility criteria.

Once you submit your loan application and supporting documents with us, our award-winning technology will match you with the best loan product for your needs, with a lender for whom you fit the credit requirements.

Start your application with CreditEnable today!

Business Loans. Enabled Simply.