Has your lender asked you to submit Form 3CB with your business loan documents, but you don’t know why? In this article, you will learn what Form 3CB is and why your lender needs it when you apply for an SME loan.

What is Form 3CB?

As a business owner in India, if your annual turnover is over 1 Crore and you’re liable to pay taxes, but it is not mandatory for you to get your accounts audits as per any law other than the Income Tax Act, you need to file Form 3CB.

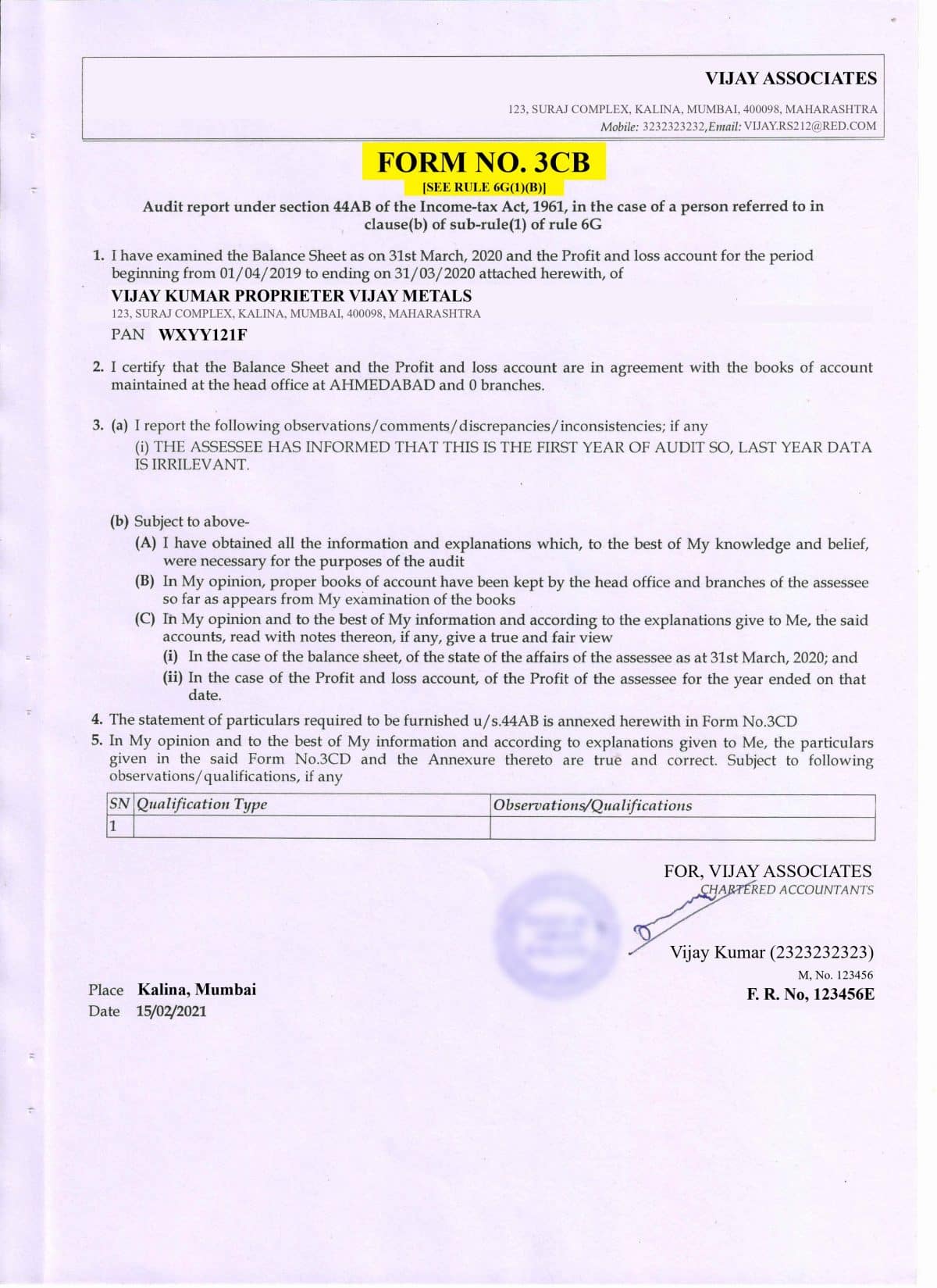

Form 3CB is an Audit Report of all the accounts you use for business transactions, generated by a certified Chartered Accountant (CA). The primary use of Form 3CB is to ensure you have paid all your tax dues on time and are not involved in tax evasion or avoidance.

Form 3CB contains your details, comments and observations on the bank audit and a declaration by the CA that all the information provided is accurate and you are maintaining your books correctly.

Here is an example of Form 3CB for your reference.

As per the Income Tax Act, your audit and subsequent Form 3CB must be ready on or before September 30th of the applicable Assessment Year. For example, if your accounts are being audited for Assessment Year 2021-2022, the Form 3CB must be obtained by September 30th, 2021.

However, due to the pandemic, the Central Board of Direct Taxes has postponed several deadlines in 2020 and 2021. They regularly release notices to inform the public about these developments. You can see the latest tax deadlines here.

Why do I need to submit Form 3CB for a business loan?

Since Form 3CB contains a declaration by a certified CA that you maintain a proper book of accounts and that your audit reports and bank accounts are without any discrepancies, your lender uses Form 3CB to gain a 360-degree view of your business accounts.

When you apply for a business loan, lenders need to ensure that they are not taking any undue risk by investing in your business. Therefore, you must submit some business loan documents with your application, which they use to check your eligibility for the loan and whether you will be able to repay it. Form 3CB provides them with information about your profit and loss accounts, which directly helps them determine whether you will be able to repay the loan.

When you submit your business loan application, make sure to include your bank account statements and other documents, including your Form 3C, to speed up the loan process.

When you apply for a business loan through CreditEnable, we do a soft pull of your credit score to determine your eligibility for the loan. If you are eligible and depending on your business type and sector, we’ll tell you exactly what business loan documents our lender partners will need to approve your loan. The sooner we get your documents, the quicker we can accurately assess your business and find you the perfect business loan to grow!

Start your business loan application today.

Business Loans. Enabled Simply.