Every earning individual and business needs to pay taxes. As a small business, when you apply for a business loan, your lender needs to ensure that you run your business responsibly and fulfil all your financial obligations to the state. So, lenders will ask you to submit certain business loan documents with your funding application – Form 3CA is one such document. What is Form 3CA, and why it is required when you apply for a business loan – read on to find out!

What is Form 3CA?

If you are a business owner and are required to get your accounts audited under Section 44B of the Finance Act, 1984, you must file Form 3CA. As per the Income Tax Act 1961, a certified Chartered Accountant (CA) must audit your taxes to verify that there is no tax avoidance or evasion. A Tax Audit is a cross-examination of your accounts by a certified CA. When you get your accounts audited, your CA must submit their findings and observations in Audit Form 3CA, as prescribed by the Income Tax Department. Only a CA registered on the e-Filing portal can access Form 3CA.

A Tax Audit helps the Income Tax Department verify the accuracy of your financial records, and the primary purpose of Form 3CA is to discourage tax fraud or tax evasion.

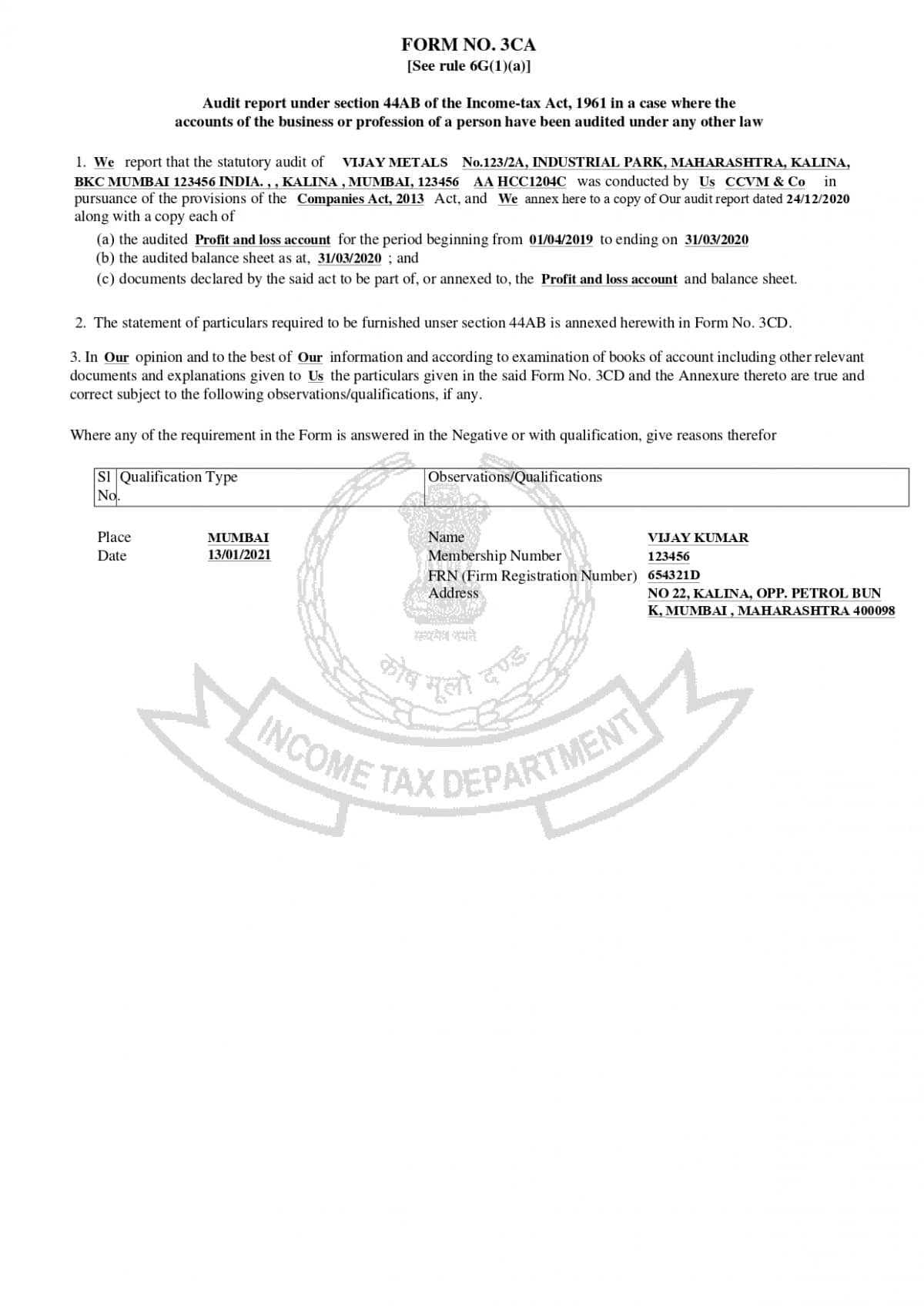

Below is the front page of a Form 3CA submitted by a certified CA.

Here is a complete Form 3CA for your reference.

Why do I need to submit Form 3CA to get a business loan?

When you apply for a business loan, you need to submit a few business loan documents, which your lender uses to check your eligibility for the loan you want. Your lender will ask you to submit Form 3CA if it is mandatory for you to get your accounts audited under Section 44AB of the Finance Act, 1984.

Your Tax Audit, done by a certified CA, is a detailed report of all your business transactions. After the audit, the CA must file Form 3CA, which becomes a reliable source for your lender to determine your business’s financial situation. It is also an assurance by a certified CA that you maintain proper books of accounts and indicates to the lender that you a responsible and trustworthy business that adheres to its tax obligations.

Finally, your Form 3CA helps the lender make their decision to lend to you, as they know that you have the financial ability to repay the loan they lend to you.

When you apply for a business loan with CreditEnable, we provide you with a list of business loan documents you will need to submit upfront. We want to be as transparent as possible with our SME borrowers and telling you what documents the lender will need at the start of the loan process gives you enough time to prepare the required documents.

See what other documents you’ll need to get business funding.

Once you have all the documents, we guide you through the business loan process to increase your chances of getting the funding you need to grow your business.

Apply for a business loan with CreditEnable today!

Business Loans. Enabled Simply.