If your lender is looking for your GSTR-3B, it’s probably because your business is a type that needs to have a GST registration according to the GST Act. In this article, you will learn what a GSTR-3B is and why your lender needs it when you apply for SME funding with a few other business loan documents.

What is the GSTR-3B?

You need to have a Goods and Services Tax (GST) registration if you are an e-commerce aggregator, supplier, or distributor, or your business’s annual turnover is over the set threshold.

If you are a GST-registered business, you must file your GSTR-3B form monthly unless they are exempt from it. GSTR-3B is a self-declared summary of your GST Return filed with your GSTR 1 and GSTR 2 forms.

Your GSTR-3B is due on the 20th of the following month, i.e., you must submit your GSTR-3B for May 2022 by the 20th of June 2022.

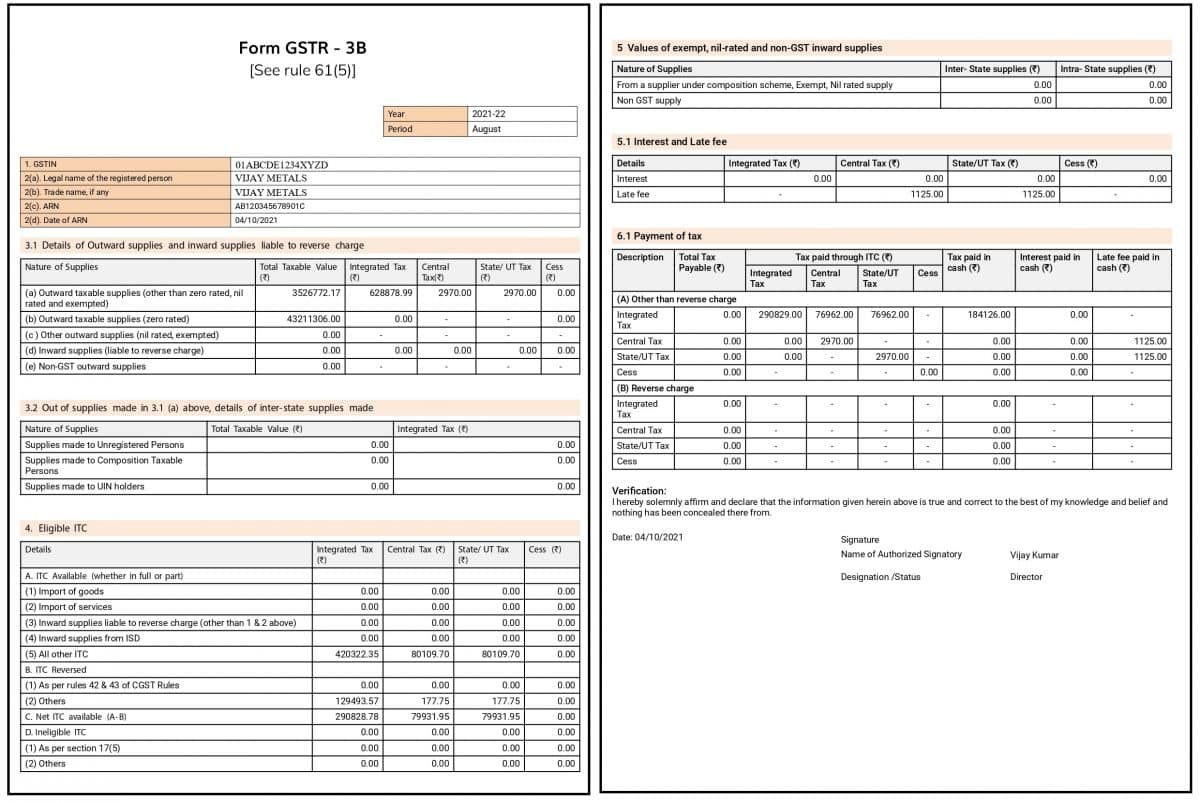

Here is a sample of the GSTR-3B form:

Why do I need to submit my GSTR-3B Form to get a business loan?

When you apply for a business loan as a GST-registered business, one of the supporting business loan documents you need to submit along with your application is your GSTR-3B forms for the past 12 months, unless you were exempt from filing.

Your GSTR-3B Form, when combined with other financial business loan documents such as your bank statement, bureau report, credit history, etc., helps lenders assess your business’s financial stability. These financial business loan documents help lenders determine whether you can repay the loan on time and according to the prescribed terms.

So, your GSTR-3B is an important document that helps your lenders decide whether they should lend to you or not. Moreover, being aware of your business duties towards the government indicates that you are a responsible business owner.

Here’s how you can download your GSTR-3B form online.

Do I need to be a GST-registered business to get a business loan?

No, if the goods and services you provide are exempt under GST law, or your business does not meet the minimum annual turnover threshold specified by the GST Act, you are not required to get a GST registration. In this case, lenders will ask you for other financial documents to assess your creditworthiness when you apply for business funding.

If you are looking for a hassle-free business loan, use CreditEnable’s free service to apply. We partner with 25+ leading lenders, and when you apply for a business loan using our award-winning technology platform, we match you with the most suitable loan product for your needs. At CreditEnable, our credit experts support our customers throughout the loan process to ensure you get the best loan terms possible for your funding needs.

If you have made up your mind to take out a business loan, and have all the necessary business loan documents ready, apply for a business loan with CreditEnable today!

Business Loans. Enabled Simply.