If your business loan lender asked you for proof of your business vintage, they are most likely looking for a document issued by a State or Central government that includes your business’s date of incorporation. One such document is your trade licence. In this article, you will learn what a trade licence is and why it’s on the list of business loan documents your lender needs when you apply for a business loan.

What is a trade licence?

A trade licence is a certificate issued by your Municipal Corporation that gives you permission to start a business or trade in a particular area/location. One key purpose of this licence is to prevent enterprises from carrying out unethical business practices. So, holding a trade licence means you have committed to following all the safety standards set by the State Municipal Corporation while carrying out your business or trading. It ensures that your business is not a health hazard or a nuisance to anyone in the state.

The issuance of a trade licence carries from one state to another depending on the rules and regulations set by the state’s municipal corporation.

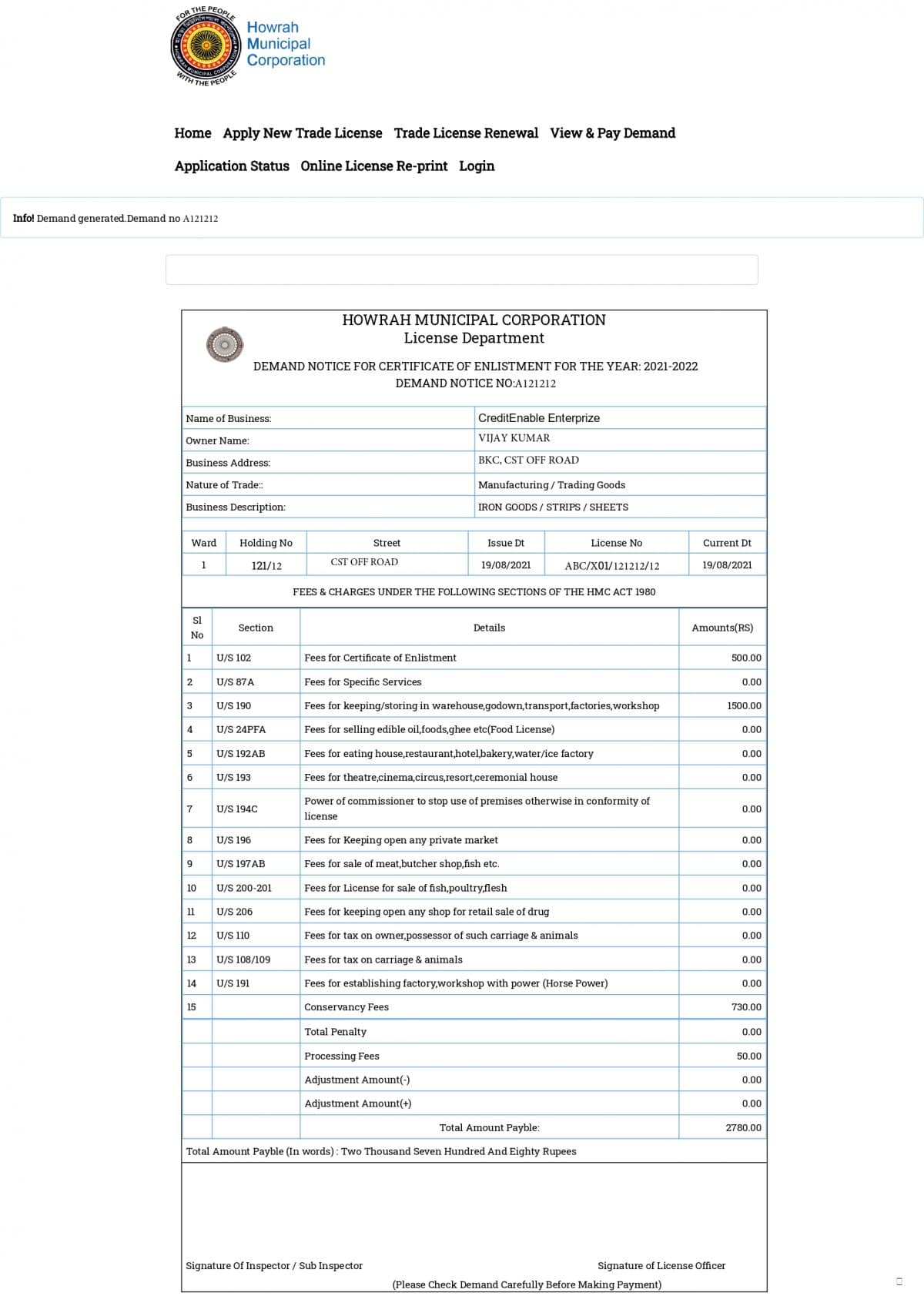

Here is a sample of a trade licence issued for storing goods in a warehouse:

Depending on the category of your business and business activity, you must apply for the appropriate trade licence. If you are a small, medium, or large manufacturer, you are eligible to apply for an Industries Licence. If you sell goods and services such as wood, candle, barber shop, etc., you can apply for a Shop Licence. Similarly, if you own a business in the food industry, you can apply for a Food Establishment Licence.

So, having a trade licence ensures that you can carry out your business activities smoothly in your state, and is also one of the business loan documents you can submit to your lender when you apply for funding.

How do I apply for a trade licence?

To apply for a trade licence, you need to be:

- 18 years old or older

- Have no criminal record

- Have legal proof of your business

You can apply for your trade licence online by visiting your specific municipal corporation’s website or submitting an offline application at your nearest municipal corporation office.

Below is the list of documents needed to apply for a trade licence:

- Aadhaar card

- Udyam Registration Certificate as business address proof

- PAN card

- Certificate of Incorporation

- NOC from the nearby property owners

- Certified layout plan of the business

- A latest Municipal Property Tax receipt

Why do I need to submit my trade licence when applying for a business loan?

When you apply for a business loan, your lender will ask you to submit a few business loan documents that help them validate and verify the information in your application. One of these documents is used to determine your business vintage.

Your business vintage, or business age, is calculated from the day you registered your business. To verify your business vintage, your lender requires you to submit a document issued by the Government of India that has your business’s date of incorporation on it. Your business vintage allows a lender to assess how long the enterprise has been operational and helps them determine your creditworthiness for the business loan you need.

Your trade licence can be your business vintage proof since it has your business’s date of incorporation. It also proves that you will be operating in the same state for a while, inspiring more confidence in the lender. If you don’t have your trade licence, here is a list of other documents you can submit as proof of your business vintage.

If you have a business vintage of more than 2 years, you can apply for a business loan using CreditEnable’s technology platform. If your business meets all the eligibility criteria set by our lender partners, we will match you with the right lender and get you a business loan in just a few days.

CreditEnable partners with 25+leading lenders in India, including Bajaj Finserv, Kotak Mahindra Bank, ICICI Bank, and Tata Capital. No matter the type of business loan you require, we will support you through the process and get you a hassle-free business loan at zero service fee.

Apply for a CreditEnable business loan today!

Business Loans. Enabled Simply.