When you apply for a business loan, your lender will ask you to submit a colour copy of your PAN card with the other supporting business loan documents. If you’re not sure why they need your PAN in addition to all the other documents you’re submitting, read on to know why.

What is a PAN Card?

Your Permanent Account Number or PAN is a ten-digit unique alphanumeric identification number issued by the Income Tax Department of India. If you are applicable to pay taxes or are filing an income tax return for yourself or your business, you must have a PAN card.

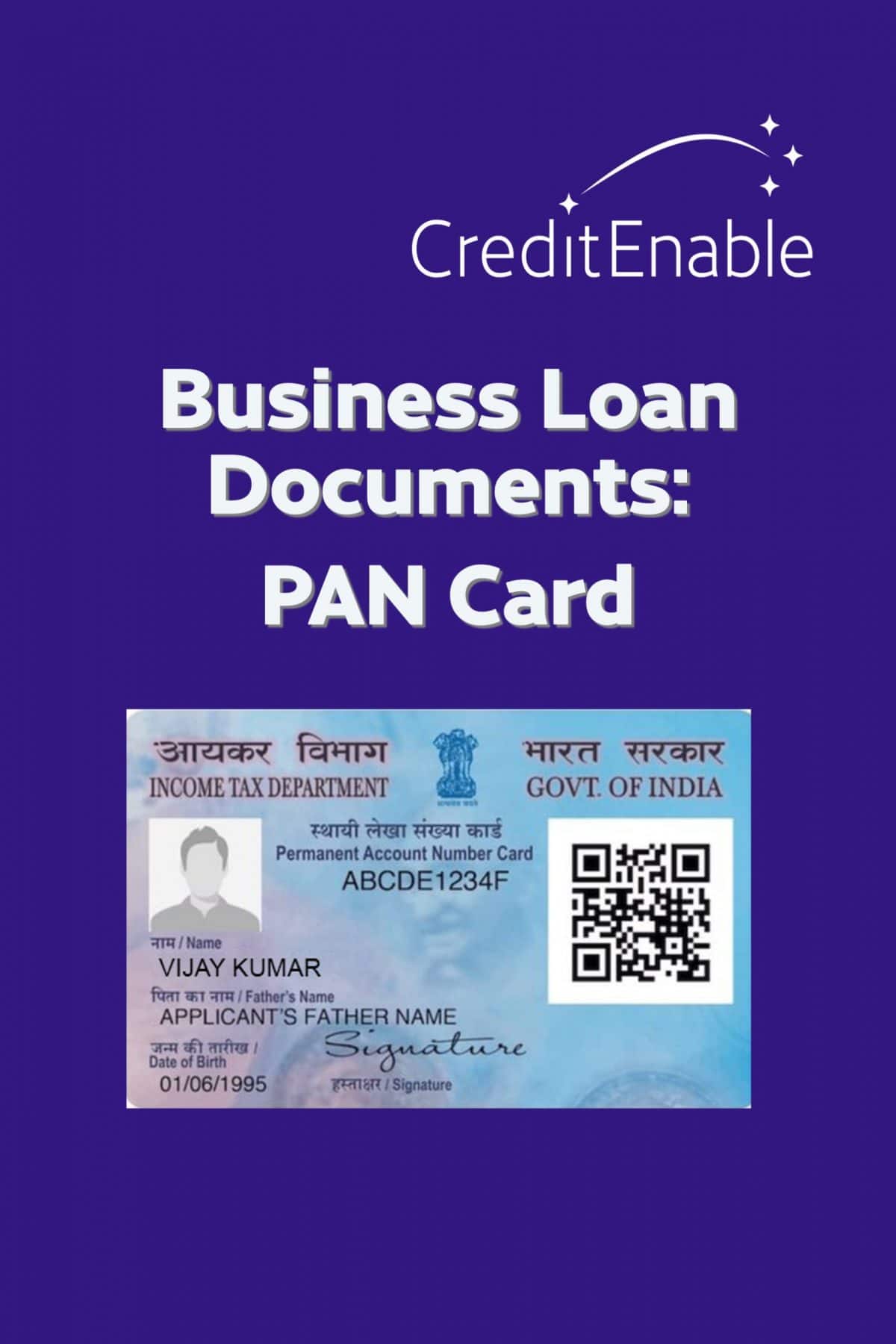

Your PAN is issued in the form of a laminated plastic card as shown below:

The Income Tax Department also issue Business PAN cards which all individuals, corporations, or foreign entities doing business in India must have. Having a business PAN card makes it easier for lenders and service providers to verify your business information.

When you apply for an SME loan, your lenders will ask for a colour copy of your PAN card along with your business loan documents.

Why do I need to submit my PAN Card when applying for a business loan?

Your PAN is an essential customer KYC document that the lenders use to verify your identity and credit history.

Your PAN is linked to your Aadhaar, bank accounts, and tax profile. It is also linked to your credit bureau profile, using which a credit bureau like Experian can access your credit history and prepare your credit report.

When you apply for a business loan, lenders use your credit report to assess your creditworthiness which helps them make their decision to lend to you.

Therefore, it is important to submit your individual and business PAN (if applicable) with your other business loan documents.

Find out how you can download a digital copy of your PAN Card.

CreditEnable Tip:

When your lender asks you to submit your PAN card, submit a colour copy of your PAN card. The features of a colour PAN card allow lenders to verify the authenticity of your ID, which they cannot do using a black and white copy of the ID.

When you apply for a business loan with CreditEnable, our credit experts guide you through the loan process so you can get your business loan easily and quickly. We give you a list of required business loan documents upfront, giving you enough time to get the necessary documents ready beforehand and avoid delays in getting your money!

If you have all your business loan documents ready, apply for a CreditEnable business loan today!

Business Loans. Enabled Simply.