When you apply for a business loan, several documents are required by the lender to verify your information before granting the loan. These documents help lenders verify the information filled out by you in your business loan application. One of the documents that lenders ask for is a “cancelled cheque” before granting you the business loan.

Read on to know what a cancelled cheque is and what the use of a cancelled cheque is when your lender is disbursing your business loan.

What is a cancelled cheque?

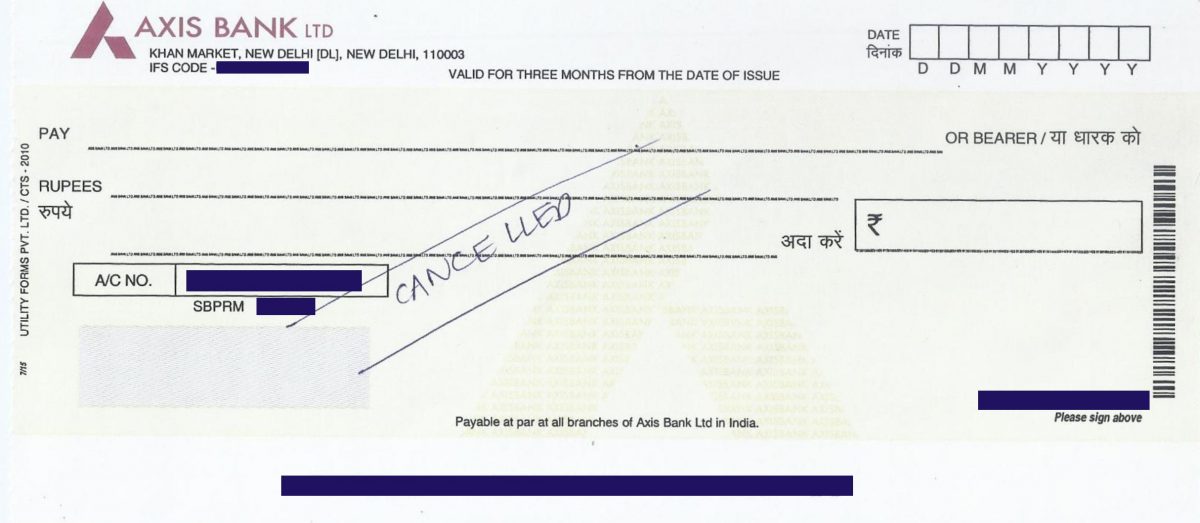

A cancelled cheque is the easiest way for a lender to verify your bank account details. It is a blank cheque, crossed with two parallel lines with the word “cancelled” written in between the lines, across the document.

Do not fill or sign the cheque to be cancelled. Its sole purpose is to be proof of your bank account details. It helps eliminate typographical errors wherever your bank account details are required.

This financial document is used to verify the following details:

- Your name

- Your bank account number

- Your bank’s name

- Your bank’s branch

- The Indian Financial System Code (IFSC) of the bank

- The Magnetic Ink Character Recognition (MICR) code of the bank

- Your bank’s location

CreditEnable Tip:

Even though a cheque that you cancel cannot be used to withdraw money, it still holds crucial information related to your bank account. So, be careful and make sure that you are sharing it with a trusted party.

Why did my business loan lender ask me for a cancelled cheque?

Cancelled cheques are required by the lenders, employers, and banking authorities to cross-check your bank details. Lenders ask for cancelled cheques for the following reasons:

- To verify that you have a bank account with the lender you mentioned in your loan application.

- To get the information of the bank account which you will be using to make your loan EMI payments.

- To verify your essential information such as name, bank name, bank location etc.

Check out what other authorities ask for a cancelled cheque and for what purposes.

How do I cancel a cheque?

To cancel a cheque, follow these steps:

- Pick a blank cheque to cancel it. Make sure that there is no other information written on the cheque.

- Use a blue or a black pen. Do not use a pencil to cancel the cheque.

- Draw two parallel lines diagonally across the cheque.

- Write “CANCELLED” (preferably in bold) between the two parallel lines. Do not write any other word or fill any other detail on the cheque.

- Make sure that the parallel lines and the word do not cover any other detail on the cheque, such as your bank account number, bank’s IFSC or MICR Code, etc.

- Do not sign a cheque that you have cancelled as its sole purpose is to verify that you have an account in the said bank.

When you apply for a business loan with CreditEnable, we do a soft pull of your Experian credit report to check your eligibility for the loan. Once we verify that you have the eligible credit score, we ask you for the supporting documents needed to further process your application. Based on the information you share with us, and the information from your documents, our award-winning lender-matching technology finds you the best possible business loan for your needs.

Apply for an SME loan using CreditEnable.

A cancelled cheque is one of the essential documents required during a loan verification process. So, keep your chequebook ready while applying for a loan and if you don’t have one, apply for one online by visiting your bank’s website or by visiting your bank branch!

Check out what other documents you will require during a business loan verification process.

Business Loans. Enabled Simply.