Before the rise of cashless and digital payments, cheques and cash used to be the most common form of payment used in the market. With innovation in technology, there has been an increasing shift towards online transactions, and digital modes of payments have become extremely popular. They are easy to use and a secure alternative to carrying cash everywhere.

Cheques, though rarely used for our daily transactions now, are still an acceptable medium of payment and are required as proof by banks and lenders for different purposes. Let’s find out whether you can still use cheques to make payments, why banks still use cheques, and how a cheque can help you access a business loan.

What is a cheque?

A cheque is a paper bill issued by your bank for transactional purposes. Through a cheque, you can transfer money from your account to the bank account of another party. When you open your bank account, you can opt to receive a cheque book linked with that specific account. Every transaction through a cheque is associated with the bank account the cheque is linked with.

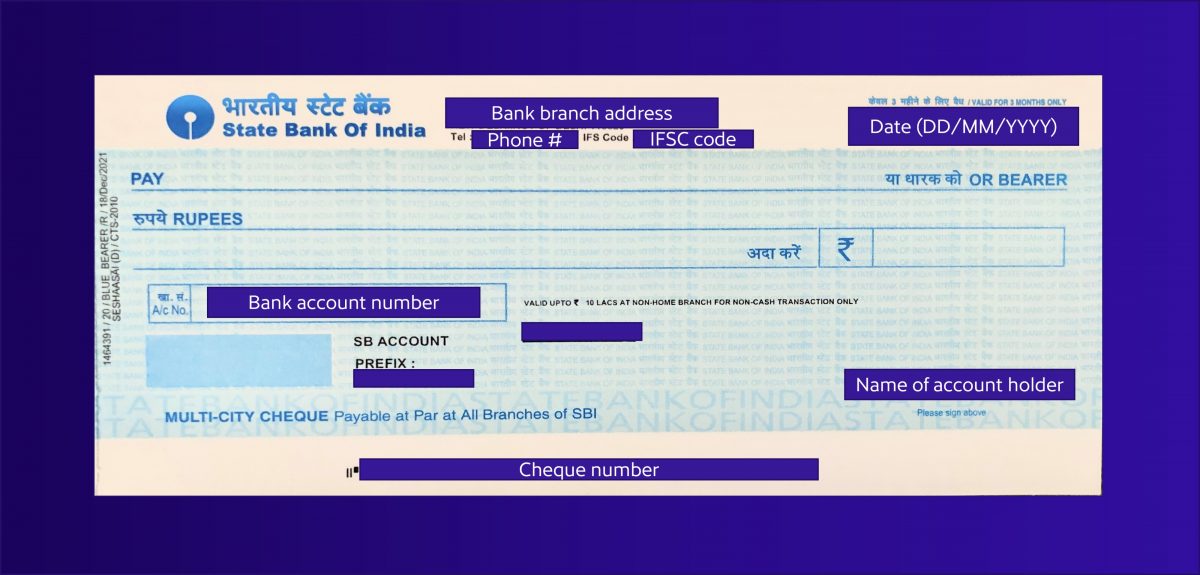

A cheque has your name, bank account number, bank name and branch, IFSC code, MICR code, and address of the branch.

The Indian Financial System Code (or IFSC) is a unique 11-digit alphanumeric code assigned to a bank branch by the Reserve Bank of India (RBI). This code is used to identify the bank branch on the National Electronics Fund Transfer (NEFT) network.

The Magnetic Ink Character Recognition (MICR) code is a 9-digit code that uniquely identifies the cheque and the bank that issues the cheque participating in an Electronic Clearing Service (ECS).

Can I still use cheques to make payments?

With an increase in financial fraud, banks are developing various strategies to strengthen their security systems and secure their transactions. To achieve this many banks have set up a daily withdrawal limit on payment gateways. For example, SBI has a withdrawal limit of Rs. 20 K per day on debit cards for Savings accounts. Similarly, your debit and credit cards also have withdrawal limits on them so making a single transaction over a predetermined limit (set by the account holder or the bank) is difficult.

Cheques help you overcome these payment limitations. Cheques are still the most secure mode of payment as they require the physical signature of the account holder to complete the transaction. The withdrawal limit for cheques continues to be higher than any other mode of transaction.

Due to these advantages, you can still use cheques to make payments in India.

What is a cancelled cheque?

A cancelled cheque is an unfilled and unattested cheque crossed out with two lines with the word “cancelled” written in between the lines, across the cheque.

When you apply for a business loan or open a new bank account, a lender will ask you for a cancelled cheque to verify your banking information. It helps eliminate typographical errors dealing with bank details. When you submit your business loan application, lenders use it to verify that you own a bank account with the lender you mentioned in your business loan application.

A cancelled cheque cannot be used to withdraw money from an account, but it still holds vital information related to your bank account. So be aware of whom you share it with.

What financial information can a lender get from a cheque?

Cancelled cheques are used by lenders as proof of financial information. It also verifies that you own a bank account through which you will make your business loan EMI payments. Using cancelled cheques, your lenders can access and verify the following information:

- Your name

- Your bank account number

- Your bank’s name

- Your bank’s branch

- The Indian Financial System Code (IFSC) of the bank

- The Magnetic Ink Character Recognition (MICR) code of the bank

- Your bank’s location

Check out what else a cancelled cheque can be used for.

When you apply for a business loan with CreditEnable, we check your eligibility by doing a soft pull of your Experian credit report. If you are eligible, we ask you for the required documents. Once we receive the required documents, we do a preliminary assessment of your finances and share your complete application package with the lender you matched with to get you the business loan most suitable for your needs.

Once the lenders process your application, they will ask for a cancelled cheque to verify your financial information so, keep your chequebook handy as proof of financial information. If you don’t have a chequebook, you can apply for one with your bank. Having all the documents ready beforehand speeds up the loan sanction and disbursement process.

Here are some tips to get your business loan application approved faster.

Apply for a business loan today.

Business Loans. Enabled Simply.