If you’re a first-time borrower, you may be contemplating your options to cover your business funding requirements. As an SME, you can apply for a business loan with a formal lender who will offer you the loan at mutually agreed-upon terms. Both you and the lender sign a contract to ensure both parties follow through with their obligations.

As an SME, you can get an unsecured business loan, secured term loan, machinery loan, loan against property, capital loan, and an overdraft/cash credit facility from a lender. Let’s find out how an overdraft is different from an unsecured business loan and which one you should get.

What is an unsecured business loan?

Unsecured business loans are the right funding option to choose when you don’t own any (or many) assets and need a business loan quick. As the name suggests, they are unsecured because they do not require any collateral, and you can use the loan to cover any business expense, from investing in new stock to covering your daily overhead.

Unsecured business loans are generally short-term in nature, with a repayment period that does not extend beyond 3 years. The interest rate lenders offer you for an unsecured business loan will also be higher compared to any other loan where collateral is involved.

At CreditEnable, we’ve enabled unsecured business loans for our SME customers in just 2-3 days at interest rates starting at 14%.

Apply for an unsecured business loan now.

What is an overdraft/cash credit facility?

An overdraft facility, also known as a cash credit account, is a revolving line of credit. The lender approves you for an overdraft with a maximum limit for a fixed duration of time, and you can use whatever amount you need (within the limit) during the tenor. You are only charged interest on the amount you use, not the overall overdraft limit.

While some lenders offer overdraft in exchange for some form of collateral, using the CGTSME, you may qualify for a collateral-free overdraft facility.

Overdraft/cash credit accounts have a tenor for 1 year, at the end of which you have the option to renew the service with the same lender.

Apply for an Overdraft/Cash Credit account.

CreditEnable Tip

The interest rate on the overdraft amount used is charged per day. Alternatively, the interest rate for an unsecured business loan is charged monthly on the entire principal amount or principal amount owed, depending on the type of interest rate payment you chose.

Learn about fixed and reducing interest rates.

Business loan or overdraft – which one should I get?

Both types of financial instruments have their benefits. When applying for business financing, you need to take into account what you will use the money for, how much money you need, and how long you need it to help you make your decision.

If you need a business loan to grow your credit history, then an unsecured loan is the best option for you. Unsecured business loans are low-value loans with short repayment periods so you can repay the loan on time and build your credit score.

Alternatively, if you simply need a stay net cash reserve for your business without having a clear idea of what you want to spend it on, an overdraft/cash credit may be the better option for you. You can treat it as an emergency business fund to cover unexpected business expenses or even as working capital when you’re watching for your accounts receivable to come in.

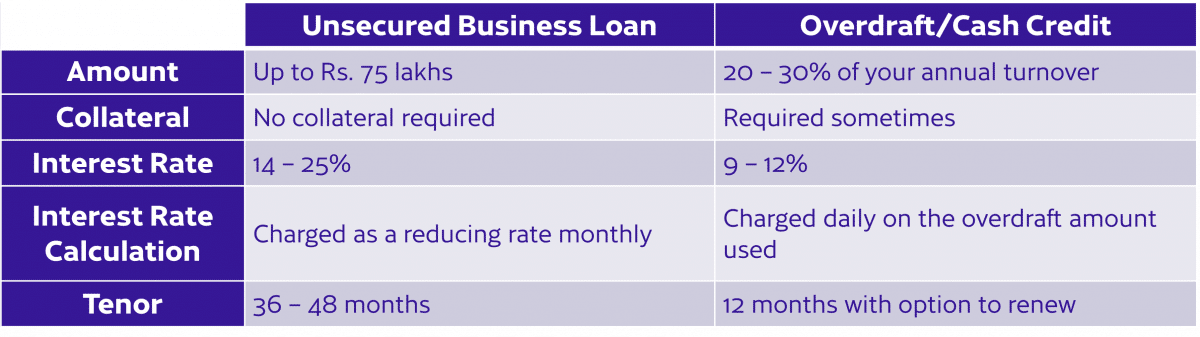

Here’s a table breaking down the two types of financial tools for you:

Business Loans. Enabled Simply.