After a “Blackout Period” of 6 days, the Income Tax (IT) Department launched its new Income Tax Returns (ITR) Filing Portal on 7 June 2021.

This upgraded portal accessed via www.incometax.gov.in (instead of the old website – www.incometaxindiaefiling.gov.in) is designed to be more user-friendly, making the ITR filing process simpler and more transparent for taxpayers. According to the Central Board of Direct Taxes (CBDT), this new platform will provide taxpayers with a seamless experience, offering functionalities like pre-filled ITR forms and quick refunds, and aims to increase ease of compliance with our tax laws.

With most States still under COVID-19 lockdowns, the e-filing system is a welcome relief for individuals and businesses alike. You no longer need to worry about not being able to file or pay your ITR dues on time because of COVID restrictions. With its customer-centric design, the new portal puts user needs at the forefront, making the filing, payment, and dispute resolution mechanisms easy to navigate.

Currently only offered in English, the portal will eventually be available in different regional languages as well.

What services does the new portal offer me?

Through the new portal, taxpayers are now able to access the following online:

| e-Verification of ITRs without log-in | More information on tax services |

| Link Aadhaar with PAN to e-file returns | Authentication of order/notice received |

| Aadhaar-PAN link status check | Jurisdictional Assessing Officer information |

| e-Pay tax | PAN-related services (new application, update, status check) |

| ITR status check | TDS on cash withdrawals using 194N |

| Verification of PAN details | Verifying service requests |

| Information on TAN deductors across India |

Instructions Section

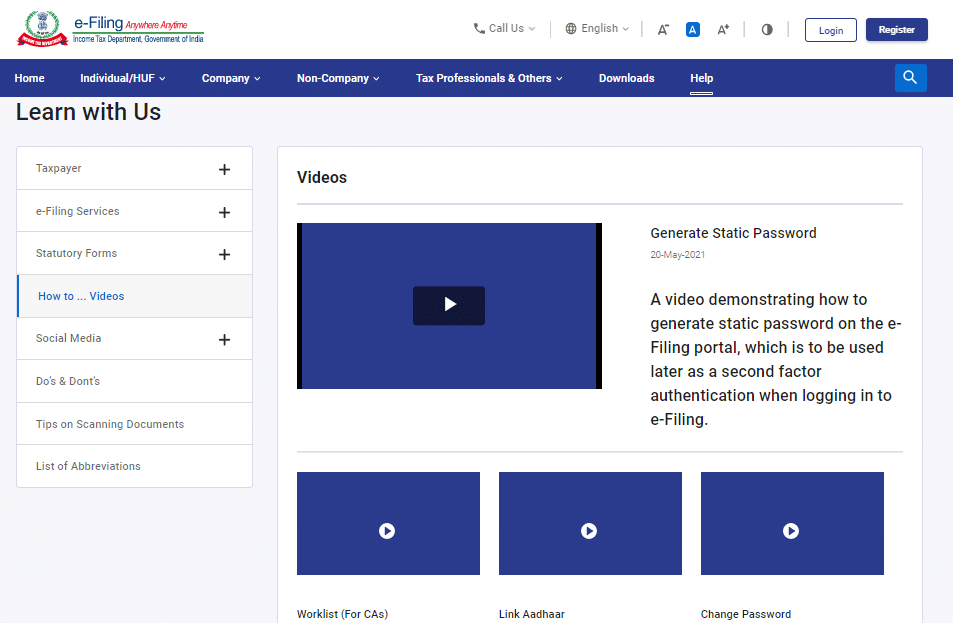

In addition to making many services accessible online, the new portal also provides users with instructional videos so that they can learn how to use these services.

Using these instructional videos, taxpayers can learn step-by-step how to use the different services, eliminating the need to have someone walk them through the system, and avoid unnecessary mistakes. You can visit it here: https://www.incometax.gov.in/iec/foportal/help/all-topics/videos.

Main features of the new ITR portal

- Integrated system and personalized profile dashboard

The new portal offers taxpayers an integrated system that allows for immediate processing of ITRs so that you are issued quick refunds. The portal also provides every taxpayer profile with a personalized Dashboard that displays any uploads or pending actions required to be completed by you. - Simplified ITR process

ITR preparation software for online and offline versions of Form 1 (Sahaj) and Form 4 (Sugam) as well as the offline version of Form 2 are now available free of cost. These include interactive questions that will guide you through the form more easily. - Profile update

Users will be able to update their profiles online with information that is used to pre-file ITRs. This detailed pre-filling functionality will be available after the TDS and SLP statements upload deadline on 30 June 2021. - Multiple payment methods

The pandemic has changed the way Indians use money. Most of our payments are now made digitally, rather than via cash or cheque. To keep up with this change in user behaviour, the IT Department also announced that a new Tax Payment System will be launched on 18 June 2021 after the Advanced Tax Due instalment date. This new system will accept ITR payments in multiple methods, including UPI, net banking, RTGS, NEFT, and credit card. - Improved customer service

In addition to the instructional videos and detailed How-To manuals, a chatbot provision has been introduced to address taxpayer queries in real time. A new ITR customer call centre will also be introduced to address taxpayer enquiries promptly. In addition to this, the ITR Portal 2.0 also provides users with numerous mechanisms of grievance redressal electronically. These will allow you to easily file a complaint and track the status of your complaint online. - Mobile Apps (Android and iOS)

This updated version of the ITR portal will soon be complemented by a mobile app that will be available to download on Android and iOS. The apps will have all the key features of the desktop version of the portal and will allow you to access your ITR profile from anywhere, anytime.

After the launch of the new portal, the IT Department asked taxpayers to re-register their Digital Signature Certificate (DSC), update the information under the Primary Contact section, and act on any outstanding or pending actions through the new portal.

Here is a video released by the ITD to help taxpayers better navigate the new ITR e-Filing Portal.