CreditEnable and Flipkart have signed a strategic partnership that will allow Flipkart sellers across the country to easily access affordable finance through the CreditEnable platform.

Today, Flipkart is one of the leading e-commerce companies in India, with 300,000 sellers and 300 million registered users.

Commenting on the partnership with CreditEnable, Ranjith Boyanapalli, Senior Vice President – Marketplace, Fintech and Payment Group, Flipkart, said:

“Flipkart remains deeply committed to enabling the growth of MSMEs and our seller community, by supporting them with their business continuity and operations. With the ongoing pandemic, affordable finance for MSMEs has become even more critical as the market dynamics continue to evolve each day. Our partnership with CreditEnable’s platform, hence, is a further step towards opening access for our sellers to affordable finance products across more than 25 lenders and 100 specialist SME loan products. CreditEnable has significantly simplified the borrowing process, and we look forward to a close collaboration to bring more affordable financing solutions to our growing seller base.“

The COVID-19 pandemic has sped up the need for innovation and digitisation. With lockdowns and travel restrictions, more and more consumers have turned to online shopping. To keep up with this changing trend in consumerism, most businesses in India and across the world were driven to shift to e-commerce in 2020.

With this development in customer behaviour, there is now a growing need to provide online retailers access to affordable finance at this critical time in their growth. So, at a time when pandemic has disrupted our access to physical bank branches, this new partnership with CreditEnable will help Flipkart sellers across India access 100% digital loans.

CreditEnable’s CEO, Nadia, believes this partnership with Flipkart will allow CreditEnable to reach more SMEs in diverse sectors across India and truly democratise access to affordable finance. Commenting on the partnership, she said:

“We are delighted to be entering into a strategic partnership with Flipkart to help their 300,000 sellers across India access affordable finance. Through this partnership, we will further increase our ability to bring easy, affordable access to finance to more SME borrowers across India. Thousands of SMEs choose us every day to help them access finance and this partnership opens up a significant opportunity as a channel for us to reach SMEs wherever they are.“

What does the partnership mean for Flipkart sellers?

Through this partnership with Flipkart, CreditEnable will be able to assess the real-time financial health of businesses based on their Flipkart transactions and provide them with more tailored products at better terms and interest rates based on their needs.

How do eligible Flipkart sellers access CreditEnable services?

Eligible Flipkart sellers simply need to click on the CreditEnable banner in the Sellers Portal and then complete the CreditEnable application.

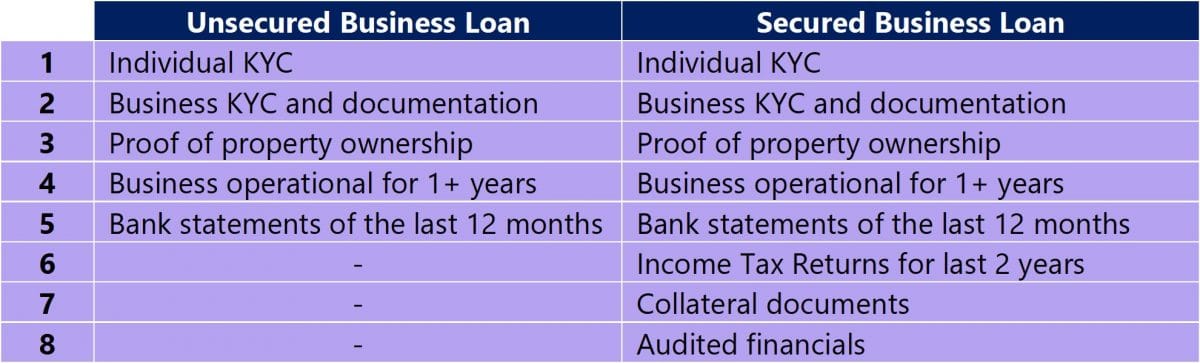

What are the requirements to get a business loan with CreditEnable as a Flipkart seller?

Eligible Flipkart sellers can learn more about accessing CreditEnable’s services through the Flipkart Seller Portal.

You can contact CreditEnable directly at +91 84509 67207.

Not a Flipkart seller? We can still help you!

Zero Hassle. Zero Fees.

Business Loans. Enabled Simply.